Business

How to Properly Host a Fundraiser

If you’re thinking of hosting a fundraiser, there are some important things to keep in mind to make sure your event is successful. From choosing the right location to marketing your event, follow these tips to ensure your fundraiser is a hit!

Know What You Are Fundraising For

When it comes to fundraising, it is essential to have a great understanding of the cause you are raising money for. Make sure you are dedicated to the cause and that you have done sufficient research. Knowing what your goal is will make it easier for you to target potential donors and discuss why your organization needs financial assistance. Remember, if you give people more details about what their donation will go towards, chances are they’ll be more inspired to help out. You need to gather ideas and research what other organizations are doing. For example, gathering fundraising ideas for PTAs or charities. This will go a long way in helping you come up with a successful fundraiser.

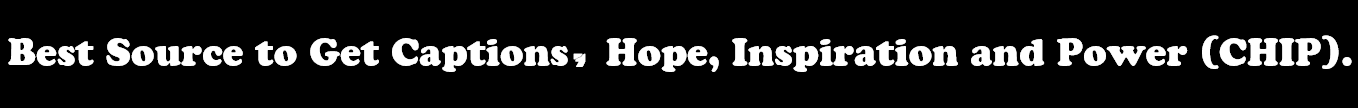

Have a Clear and Attainable Goal for Your Fundraiser

Before you launch your next fundraiser, it’s important to make sure that you have a solid goal in mind. Finding success and meeting your expectations is likely dependent on having an attainable or realistic goal. An audacious and ambitious fundraising goal may feel great at first, but without something a bit more within reach, it could quickly become discouraging and discourage people from continuing to give throughout the course of the fundraising effort. It’s also important to be able to prove the impact that any donations have made if you need to fundraise again down the road. So make sure that when you set out on your next fundraising endeavor, have a goal that can be not only attained – but exceeded as well!

Get the Right People Onboard

Regardless of the size of your fundraiser, you’ll require assistance in both setting it up and managing it. Whether you have the support of family and friends or are working solo, recruiting volunteers is essential. But how do you attract volunteers? Begin by networking with individuals who are passionate about the cause you’re fundraising for. Once you’ve connected with interested parties, explore various volunteer recruitment ideas to broaden your reach and simplify the process of recruiting volunteers for your fundraiser. Once you’ve assembled a team of volunteers, assign roles and assess their availability to ensure the smooth operation of your fundraiser.

Choose the Right Venue

Choosing the right venue for an event is a critical decision. Conveniently located and easy to access, the venue should ideally be accessible by public transport or parking to accommodate all attendees. If possible, it should also offer a range of additional facilities such as catering, audio-visual equipment, and seating arrangements that fit your event format. When making this important choice, consider your audience in terms of geographical location and mode of transport available to them; a great venue can make or break the success of your event and it is well worth doing thorough research before booking!

Advertise Your Event Using Various Channels – Social Media, Email, Flyers, Etc.

If you want to attract maximum attention to your event, it’s essential to think beyond traditional forms of advertising and be creative with the platforms you use. Leveraging social media, email mailing lists, and designing eye-catching flyers can help get the word out quickly and without having to go over budget. Socially active communities, such as Instagram influencers or focused Facebook Groups can provide a further boost in promotion. Don’t forget that people may not find your event if they don’t know it exists — so no matter how small or large your event is, make sure you reach out strategically and keep finding new ways for it to stand out in the crowd!

Make Sure You Have Enough Food and Drinks for Everyone

If you want to ensure success for your fundraiser, it’s essential to make sure you have enough food and drinks for everyone who attends. Having too little of either can cause feelings of disappointment and frustration in guests, which could spoil their overall experience at your event. Plus, a shortage of food or drinks could lead to more people at the fundraiser than you were expecting—which can quickly become a logistical nightmare. Loss of money due to forgotten provisions might seem small but this accumulates over time, which ultimately results in a significantly less profitable fundraiser. So plan ahead and pay close attention to how much food and drink everyone will need; it’ll be worth the extra effort!

Have Fun!

This fundraiser is so much more than a fundraising opportunity; it’s a chance to come together, have fun and be part of something bigger! Sure, the money we raise is important, but having a good time in the process is equally as vital. So don’t be shy – let your hair down and enjoy yourself! Make some memories that you’ll never forget; now is not the time to be conservative or reserved. We might all have different reasons for being here but at least we can share in having an incredible experience!

Invite Key People

When it comes to ensuring success for any fundraising event, it’s essential to invite key people. This includes influential figures in your community or field, as well as potential sponsors and donors who could make a difference in the outcome of the fundraiser. Inviting these people not only increases the odds that they will show up but also helps build relationships with the people who might be most likely to donate to your cause.

It also provides an opportunity for you to thank them for their support, whether it’s financial or otherwise. Make sure that everyone feels welcome and appreciated — no matter how important they are! The more guests feel involved and engaged, the more likely your fundraiser will reach its goals.

Use your chance to network and build relationships that can benefit your cause in the future.

Remember to also thank people for their attendance — it’s a nice touch and helps to strengthen relationships even further!

In conclusion, holding a successful fundraiser requires careful planning and attention to detail. You need to know what you are fundraising for and have a clear achievable goal in mind. Choose the right venue and advertise it through multiple platforms like social media, email, flyers, etc. Make sure to provide adequate food and beverage so that everyone can enjoy the event, and don’t forget to kick back yourself and have some fun! Inviting key persons or celebrities can also be of great help to spread the word about your event. Don’t forget that with passion and determination, you can raise plenty of money for your cause or project!

Finance

4 Reasons You Should Care about Your Credit Score

If applying for a small business loan, your credit score can make or break your chances of securing one and getting a good interest rate.

Whether starting a business, looking to expand, or requiring funds for other purposes, you may one day need a business loan. Getting the best terms possible is a priority. That’s one reason to consider your creditor score and how it’ll factor into your search for a business loan.

Here are four reasons your credit score matters. You’ll also see how to get help with credit score disputes if you can’t resolve such conflicts independently.

1. Credit Score Determines If You Get a Business Loan

If getting a business loan is a make-or-break issue for your company, you should be mindful of your credit score. Remember that lenders aren’t in the business of offering loans to people who present a substantial risk.

So, if your credit score is less than optimal, lenders could balk at lending you a loan or offer less money to reduce their risk. It’s a good idea to consider your credit score to see if you can realistically qualify for a business loan with reasonable terms.

Otherwise, you may have to explore other options to secure money for business needs. There are alternative ways to get funds. But it might mean accepting a higher interest rate or onerous terms.

2. Credit Score Affects Your Interest Rate

Even if you qualify for a business loan, you may not get a good interest rate if your credit score isn’t good. Even a few percentage points more could translate into paying back thousands more to complete your payback obligations.

You’ll have to consider whether you can afford to shoulder a high premium in interest payments to get a business loan you might not qualify for otherwise.

If forced to pay higher interest for a business loan, the lender may have other stringent terms. You should carefully consider the particulars before signing on the dotted line.

3. Credit Score Can Impact How Much You Qualify for

As was mentioned above, your credit score can influence how much a lender is willing to lend. If your credit is not good enough to grant you the amount you want, a lender may offer a business loan for a fraction of that sum.

That can happen when a lender doesn’t feel comfortable enough lending you more than a specific amount. It’s about limiting the potential fallout if you’re unable to pay your loan.

When a lender looks at your finances, it’ll know how much you can afford to pay back. If it determines you’ll struggle to pay back the amount you request, it might simply offer a lower amount more in line with your cash flow.

4. Credit Score Can Throw a Wrench in Your Business Plans

You may struggle to grow your business if you desperately need a business loan but have poor credit. In fact, you may face financial problems that threaten the long-term viability of your company. So, your credit score can make or break your business. Don’t allow bad credit to throw a wrench into your plans. If possible, improve your credit score before applying for a loan.

While a bad credit score can cause problems for your business, there are times when your credit report may include inaccurate information. Whether the credit report hasn’t been updated or includes completely false information, you may struggle to get the information corrected.

If you can’t make progress on this front, you may need to speak to a lawyer. A legal professional experienced in helping clients involved in credit score disputes can be a godsend.

Business

How Has E-commerce Evolved?

E-commerce has a relatively short history in business. The earliest incarnations of e-commerce stretch back to the 1970s, when early technologies such as teleshopping and Electronic Data Interchange helped to create a primitive version of this form of commerce.

However, modern e-commerce started to take off in 1994 when the entrepreneur Jeff Bezos set up Amazon from his garage. Initially, Amazon was an online marketplace just for books. In the years that followed, the range of products available increased.

Today, millions of unique products can be bought on the site, which has led it to become known as “the everything store.” Today, there are estimated to be over 26 million e-commerce websites worldwide, with around 13 million based in the US.

The e-commerce sector has grown rapidly and is predicted to continue to enjoy year-on-year growth for the foreseeable future.

However, in its relatively short history, there have been several developments that have shaped how companies operate online. In addition, consumer behavior and shopping preferences have changed as people regularly buy products and services online.

In this article, there will be a discussion of how e-commerce has evolved. Some key examples will be used to support this.

Social media promotion is integral to the sector

In the early days of e-commerce, there was far less competition between businesses because there were far fewer e-commerce firms. The internet has grown at an exponential rate since the early 1990s, and consumers can now find virtually any product, service, or specialist e-commerce firm online.

Due to the massive growth in the e-commerce sector, online firms now need to have a comprehensive marketing plan to promote their site and their products. This is vital to allow companies to stand out in an increasingly crowded online marketplace.

A key marketing strategy for millions of e-commerce firms is leveraging social media promotion’s power. Popular social media sites such as TikTok have around 1 billion monthly users, which makes the site a prime avenue for online promotions.

There is a global community of visitors to the site, which encompasses a wide range of demographics and target markets. Today, most e-commerce sites will have a marketing budget specifically for social media promotions.

They will create short but memorable adverts (typically using video) and will ensure that a hyperlink is embedded in the advert that takes the viewer to the product page of their website.

This simple strategy transforms customer interest into a sale with the lowest number of steps required on the part of the consumer. In short, social media promotion is a vital activity for any e-commerce firm and helps them to stand out in an increasingly crowded online marketplace.

The changing attitudes to delivery

In the early years of e-commerce, consumers understood that delivery timescales may be relatively long. Many customers were starting to buy from international sellers or fledgling e-commerce firms in their own country. During the early stages of e-commerce, there were few advanced delivery networks for online firms.

During the 1990s typical delivery timescales were far longer than today. Most products would take at least five days to arrive and potentially could be in transit for weeks.

Whilst consumers tolerated these timescales in the early days of e-commerce, they now expect quicker delivery schedules. In addition, if the stated delivery period is not adhered to and there are delays, many customers will stop using the e-commerce site.

As consumer delivery expectations increase, e-commerce firms must ensure that they can work with dependable and efficient shipping and courier firms. Companies such as Shiply USA may be ideal for smaller e-commerce firms that do not have their own delivery networks.

Such firms can offer highly competitive prices for shipping a range of goods. In addition, they have built a reputation for delivering to pre-stated timescales, with minimal levels of damage to items in transit.

In short, all e-commerce firms need to forge strong working relationships with professional shipping firms who can deliver on time and with competitive fees.

The rise of chatbots in online customer service

Finally, modern online shoppers expect that any queries or questions that they may have will be answered swiftly with excellent customer service. Not receiving a timely response to their correspondence creates a negative perception of the company and may make them less likely to purchase from the site.

E-commerce firms have been quick to recognize the value of swift responses to customer queries and are increasingly using AI to facilitate this. Chatbots are now widely used in e-commerce. They are programmed to understand language and detect the key question raised, directing customers to specific web pages with information on the topic.

This can help customers get the information they need and reduce the reliance on a large human customer service team, keeping such staffing costs low.

Business

8 Tips for Better Product Consistency

When it comes to building a business that people trust and recognize, there’s no replacement for consistency. More specifically, you need the quality and output of your products to be consistent across the board.

However, with so many different moving parts involved, this is often easier said than done.

- Standardize Your Processes

Start by examining your current processes and how things are being handled at every step of the production process:

- Are they documented?

- Where are they documented?

- Is there a clear blueprint that everyone can follow?

Standardization is the backbone of consistency. It involves setting clear guidelines for every stage of your production, from the initial design to the final output. This means having detailed, step-by-step instructions that leave no room for ambiguity.

It’s a smart idea to implement checklists and workflows, which are easy for people to follow. This ensures every product goes through the same procedure, minimizing variations that can lead to inconsistencies.

- Implement Rigorous Quality Control

Quality control is non-negotiable. With that in mind, introduce systems that scrutinize your products at multiple stages of the production process. This might involve regular spot checks, pre-shipment inspections, and even post-market quality assessments.

The goal of quality control is to catch and address any deviations before they reach the customer. Consider adopting statistical quality control techniques like Six Sigma, which can help you measure, analyze, and reduce variability in your manufacturing process.

- Leverage Technology and Automation

Don’t ignore the resources you have available at your fingertips. This includes technology and access to outside partners.

In terms of tech, automation has the ability to reduce human error and ensure that each part of your product meets exact specifications. When it comes to outside partners, you can always hand off parts of your process to an experienced contract assembly company to make sure you get the same result every single time a product is packaged.

- Train and Engage Your Employees

Your employees are the real MVPs behind your product, and their skills and commitment play a pivotal role in consistency. Even if the majority of the production is happening with the help of automation, it ultimately comes down to the people who are implementing the systems, spot-checking the production processes, and keeping everything running.

The best thing you can do is invest in comprehensive training programs that teach your employees about the technical aspects of their jobs while instilling a deep understanding of the importance of consistency. Engaged employees who share a commitment to your brand’s standards are less likely to cut corners and more likely to maintain high quality in every task they perform.

- Gather and Utilize Feedback

Feedback is a powerful tool – don’t ever forget it. While not always comfortable – and quite often painful – gathering feedback forces you to come eye-to-eye with how you’re actually doing. (Not just how you think you’re doing.)

Gather input from your customers, employees, and even suppliers on a regular basis to find out where there might be inconsistencies in your product. This can provide invaluable insights into areas that may need adjustment. Use this feedback to fine-tune your processes and training, ensuring that your products continually meet customer expectations and industry standards.

- Monitor and Adapt Your Supply Chain

The consistency of your product is also highly dependent on the materials you use. Variability in materials can lead to variability in the final product. Keeping this in mind, build strong relationships with reliable suppliers whose products meet your quality standards.

Regular audits and supplier evaluations can also go a long way towards helping ensure that the materials you receive remain consistent in quality and function.

- Set Realistic and Clear Expectations

While striving for perfection, set realistic expectations for your team and your processes. This might seem like an oxymoron, but it’s all about your mentality. Perfection is always the goal, but you also have to remember that people are people – meaning they will make mistakes.

Don’t accept these mistakes, but also don’t ruin relationships when people don’t live up to the goal of perfection. Instead, go back to the drawing board and find ways to limit those mistakes in the future.

- Prioritize Continuous Improvement

The journey to product consistency is one that never ends. Markets evolve, technologies advance, and customer preferences change. Maintain a mindset of continuous improvement, regularly reviewing and refining your processes to adapt to new challenges and opportunities.

This proactive approach will keep you ahead of the curve, ensuring your products consistently meet the high standards your customers expect.

Invest in Consistency

If you make a commitment to product consistency, you’ll never regret it – not even for a day. It can be costly and time-consuming on the front end, but it’s one of the most financially rewarding investments you’ll ever make in the long run.

Start with the tips highlighted in this article and begin shifting your focus in a new direction!

-

Captions3 years ago

Captions3 years ago341 Sexy Captions to Fire Up Your Instagram Pictures

-

Captions3 years ago

Captions3 years ago311 Night Out Captions for Instagram and Your Crazy Night

-

Captions3 years ago

Captions3 years ago245 Saree Captions for Instagram to Boost Your Selfies in Saree

-

Captions3 years ago

Captions3 years ago256 Best Ethnic Wear Captions for Instagram on Traditional Dress

-

Captions3 years ago

Captions3 years ago230 Blurred Picture Captions for Instagram

-

Captions3 years ago

Captions3 years ago275 Deep Captions for Instagram to Express Your Thoughts

-

Quotes3 years ago

Quotes3 years ago222 Nail Captions for Instagram to Showcase Your Fresh Manicure

-

Captions3 years ago

Captions3 years ago211 Laughing Captions for Instagram | Laughter Is the Best Medicine